-40%

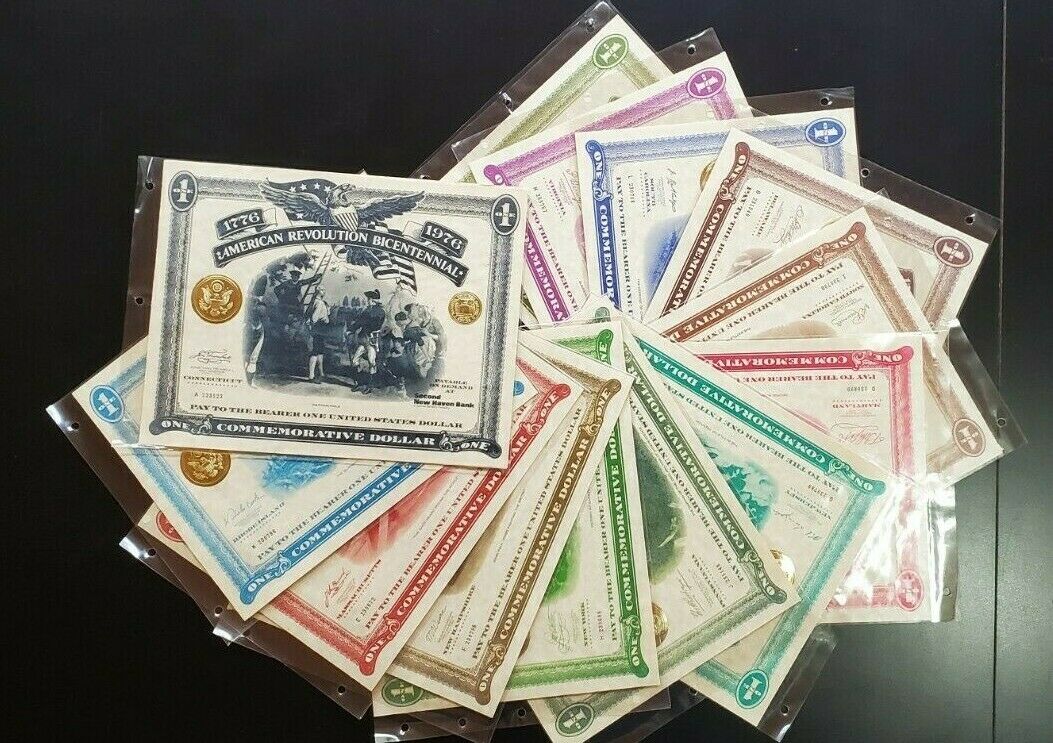

OPPENHEIMER issued collectible stock certificate share

$ 2.63

- Description

- Size Guide

Description

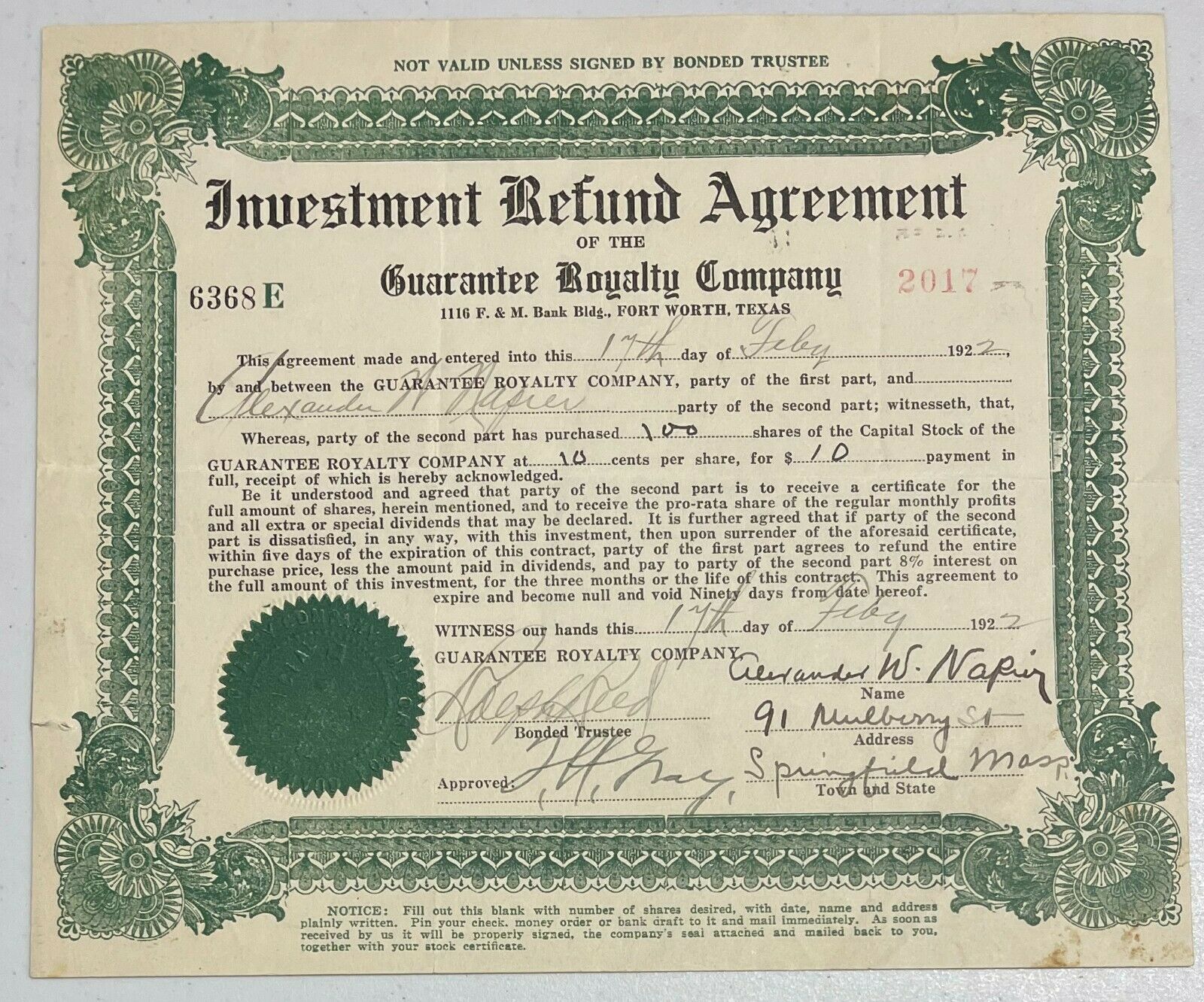

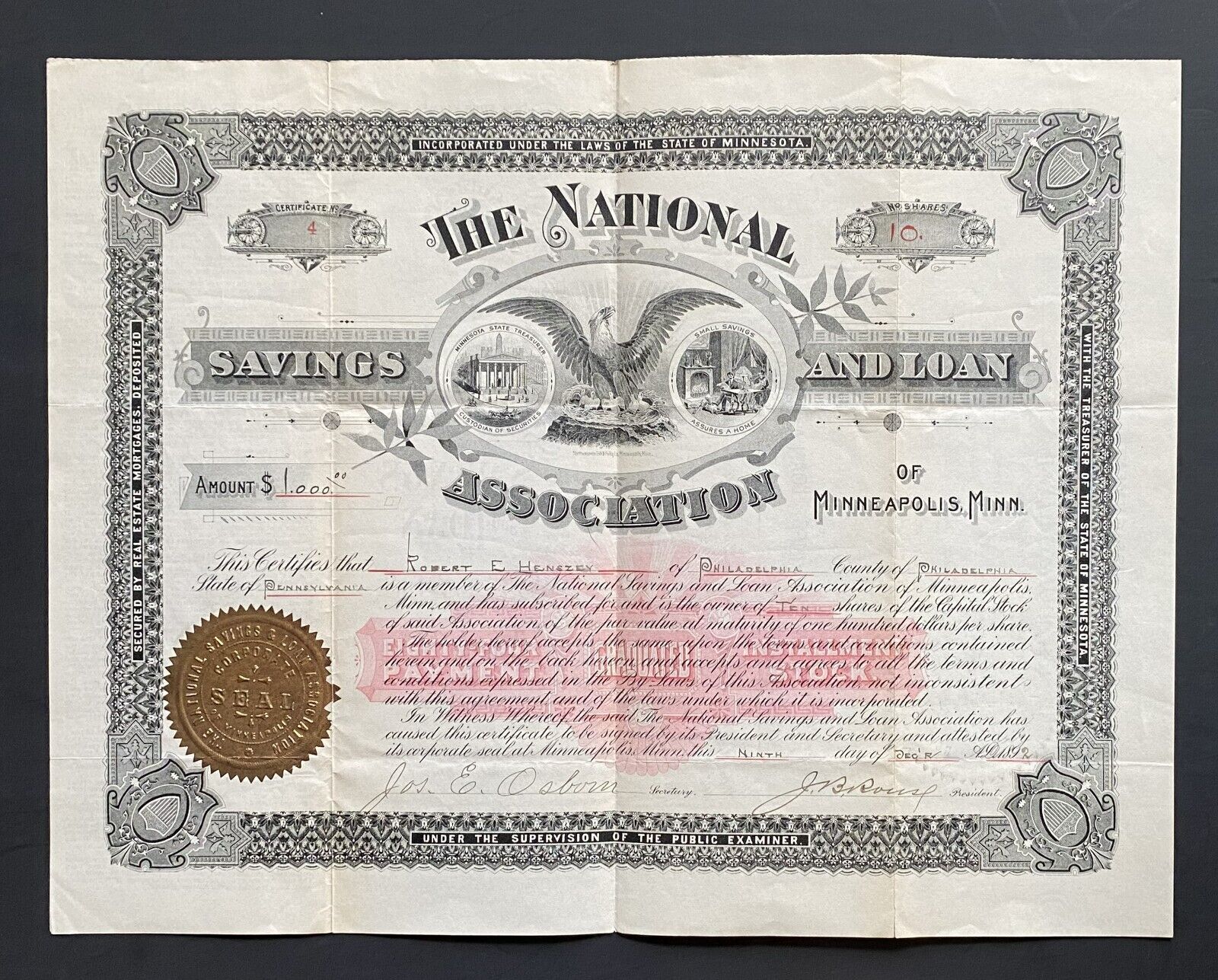

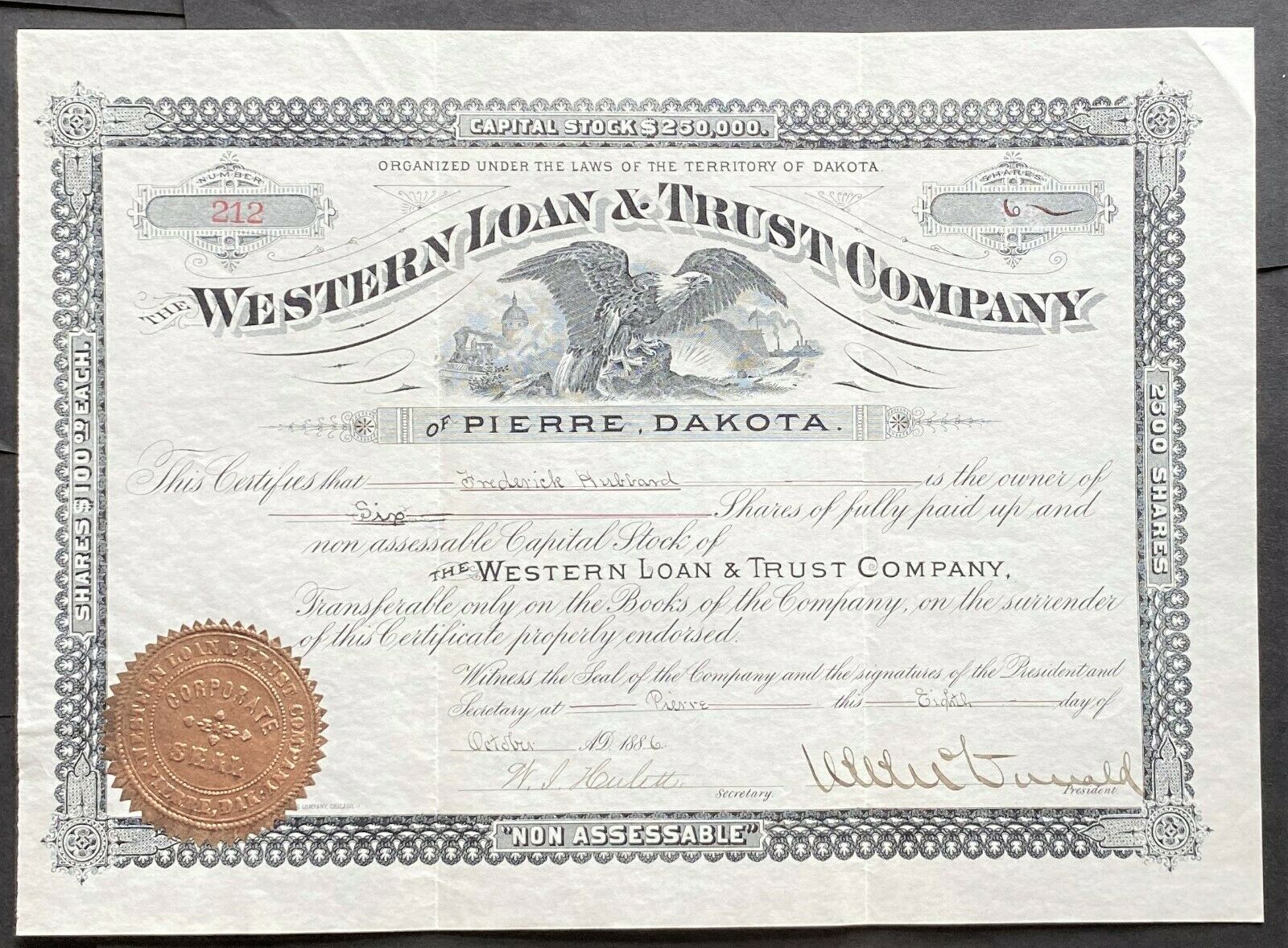

Old Stock Yard Collectible Stock and Bond CertificatesStock certificate issued to

Oppenheimer & Co.

Original Jefferson Stores stock certificate

Issued in 1973

Attractive certificate with beautiful vignette

More information on Oppenheimer & Co:

Oppenheimer & Co., Inc.

("OpCo"), a wholly owned subsidiary of Oppenheimer Holdings, offers investment banking and financial advisory services, capital markets services, asset management, wealth management, and related products and services worldwide. The firm's world headquarters is located in Toronto. The company, which once occupied the One World Financial Center building in Manhattan, now bases its operations at 300 Madison Avenue and 125 Broad Street in New York, NY, and at 6 Gracechurch St in London, UK.

History

The company was founded in 1950 when a partnership was created to act as a broker-dealer and manage related financial services for large institutional clients. The 1960s and 1970s was a time of great prosperity for the company which eventually led to the 1975 restructuring. Oppenheimer & Co. formed three operating subsidiaries:

* Oppenheimer & Co., Inc., a retail brokerage firm

* Oppenheimer Capital Corporation, an institutional investment manager

* Oppenheimer Management Corp. (now OppenheimerFunds, Inc.)

In the 1980s, OpCo founding partners began looking for a buyer. Mercantile House Holdings, PLC, a publicly owned British corporation made an offer in 1982 which was accepted and closed a year later. In 1986, a majority interest was bought in Oppenheimer & Co and Oppenheimer Capital by the firm’s management, Stephen Robert and Nathan Gantcher along with a small group of their colleagues from Mercantile, for 0 million. A year later, British & Commonwealth Holdings, PLC, acquired Mercantile. The 1990s brought another separation of the original firm when Oppenheimer Capital's senior personnel acquired a majority interest in the subsidiary and separated from OpCo. In 1995, Robert and Gantcher, who controlled about 40 percent of OpCo's equity, became eager to locate additional capital to grow their firm. At first, OpCo explored options of forming a possible alliance with ING Groep NV that eventually fell through. Carrying on with this goal management set out to merge with a bulge bracket bank that has access to the foreign markets.

Robert and Gantcher entertained offers from the second-largest private German financial institution and retail bank, Bayerische Vereinsbank. On Thursday, May 8, 1997, the Wall Street Journal announced that Pittsburgh-based PNC Bank Corp. was in talks to buy Oppenheimer & Co. for about 0 million in cash, stock and options. The article’s source warned that PNC and Oppenheimer hadn't arrived at a fixed price and that chatter could break the formal agreement, which was two weeks or more away. Analysts speculated that PNC would be paying too much for a brokerage house that no longer carried the brand-recognition it once did in the securities industry. Only 13 days following the announcement, the Bloomberg News desk announced that for the third time in two years, OpCo had been abandoned by a prospective buyer. Two months later it was announced that CIBC wanted to expand its brokerage business and was interested in the New York-based investment banking firm which had annual revenues of 0 million and 680 brokers who sell stocks and bonds. - Wikipedia

Old Stock Yard Policies and FAQs

Please visit my eBay store

– any combined certificate purchased

ship free

with auction items!

Shipping and Handling Charges:

.99 for one certificate to the U.S.

.99 for one certificate to the rest of the world

Additional, combined certificate purchases

ship for free

!

Shipping Method and Timing:

Certificates are carefully packaged in poly bags and rigid envelopes to protect them during shipment. Items are sent via U.S.P.S. – usually first class, but occasionally priority or parcel post. Most items will be mailed within 48 hours of payment.

Payment Method:

In accordance with

eBay

policy, my listings are setup to accept

Paypal

payments. Sellers are allowed to accept other forms of payment only if the buyer requests another payment method – so if you prefer to pay using a method other than Paypal, please let me know.

Return Policy:

Items can be returned for any reason within 15 days of purchase. A full refund will be issued upon receipt of the return if the item is the same condition it was in upon delivery.

FAQs:

Are you your certificates authentic or copies?

Everything

I sell is original and authentic. I do not sell copies or reproductions.

Is the certificate pictured the exact one I will receive?

Usually, yes. Occasionally, I do list certificates of the same type without rescanning. In this case, the certificate you receive will be virtually identical (same color, size, vignette, etc.) to the one pictured. Again, if you ever receive anything from me you are not 100% pleased with, you can return it for a full refund.

What is the best way to store, protect, and display my certificate collection?

The best thing, by far, that I have come across for storing certificates are

profolios and sleeves made by Itoya

. You can purchase them in my eBay store. I have several sizes available.

Do the certificates you sell have financial value?

No, these certificates are sold as collectibles only; although they are authentic, they no longer hold financial value.